by David | Apr 10, 2015 | Real Estate Basics

Amortization is one of the most amazing concepts in real estate investing. It has to do with another amazing concept called OPM, which stands for Other People’s Money. Before we get to amortization, the idea behind OPM is that you don’t have to use your own money to purchase properties (or, at least you don’t need to use all of your money for the purchase). An obvious example for OPM is a mortgage. If there’s a property you want to purchase that’s valued at $100,000, you don’t need to have $100,000 in order to purchase it. With a conventional loan, you only need 20% of that price. In other words, if you only have $20,000 you can still purchase a property that’s worth $100,000.

That’s a simple example of OPM. Now, what is amortization? Amortization is the fact that, over the course of the life of that loan, you’re paying it down and slowly owning more of that property.

For example, the day after you purchase that $100k property with $20k of your own money and finance the other $80k from the bank, you own 20% of that property. Since you’re paying the bank a mortgage payment every month, you’re slowly paying back that loan. So after 10 years, you won’t own only 20% of the property, you’ll own 30% of it. And after 30 years (if this is a 30-year loan), you’ll own 100% of that property. In other words, you initially paid 20% of the price and after 30 years you’ll own the entire thing.

But, David, like you said, we’re making monthly payments to the bank to return the 80% back to them. That’s right, but the question is who is paying them back? If you’ve purchased the right property, your tenants’ rent payment should pay back the mortgage. You can see an example from my first home here. With my first property, the rent paid by my renters covers not only the mortgage but also all expenses! The rent pays for the mortgage, insurance, taxes, property management, and maintenance. In other words, my tenants are paying the bank back for the loan that I borrowed.

So, amortization is that slow increase of how much of the property I own vs. how much of it the bank owns. After 30 years I should own the additional 80% of the house without spending any more than my enitial payment of 20% of the property price.

Another example: Let’s say I’m able to save $20,000 a year for the next ten years, and every year I purchase a property with a conventional 30-year loan. After 40 years, I’ll own the ten houses free and clear (no more mortgages). So, in the first ten years I spent $20,000 per year, and after 40 years I’ll have ten houses for a total value of $1,000,000 (not taking appreciation in to account).

That’s how amortization is an amazing part of real estate.

by David | Apr 1, 2015 | Income Report

March, like February, was pretty normal in regards to income from my two rental properties. I spent time this month checking out different properties and, as I wrote in a previous post, I found house #3 which is currently being renovated.

This month’s numbers are:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

Since it’s the end of the first quarter of 2015, I spent some time looking at the goals I defined for this year and checking where I’m at with each. Here’s a quick review:

- Finance goals:

- Save at least $45,000 – So far this year, we were able to save $12,000 which puts us slightly above our monthly goal of $3,750.

- Purchase 3 additional properties – I plan to purchase my third rental property next month so we’ll be at 1 out of 3 for the year.

- Grow my net worth to $150,000 (it’s currently at $100,000) – Since the savings are going well, we’re on course with this goal. Other pieces that are working to my advantage is:

- Amortization – the fact that rent paid by my tenants is paying off the mortgages and specifically the principle I owe means that I own more of each house (slowly but surely). I’ll calculate this and blog more about it towards the end of the year.

- House value increase – House prices going up will also contribute to the net worth goal.

- Real estate income – Besides saving from the income we receive from our day jobs, we also have a stream of income from our rentals which is helping our net worth grow. Some of the cash flow we use to make additional payments on the mortgage and reduce the principal, but the rest is accumulating and working toward building our net worth.

- Personal goal:

- Start a family – We’re pregnant! Super cool and super exciting! It’ll be interesting to see how having a baby will affec our ability to continue saving.

- Passive REI blog goal:

- Write one post per week – I haven’t been doing well in this area. I’m currently at about one post every two weeks, so I will need to spend more time on the blog since there is a lot I’d like to share!

So that’s how 2015 is starting out! What do you think?

by David | Mar 15, 2015 | My REI History

Earlier this month, I blogged about how February was a month of “getting back into the game” after a break I took since purchasing house #2 late last year. Well, I’ve been doing a bunch of networking and studying different markets and potential investments. In the end, I decided on the next property I want to purchase and signed the contract on this house today!

The house is located in Memphis, TN and is priced at $54,700. The yearly net operating income is $6,127, which means the cap rate is 11%. The rest of the numbers are:

| Item |

Amount |

|---|

| Rent |

$675.00 |

| Insurance |

$26.50 |

| Taxes |

$70.41 |

| Management |

-$67.50 |

| Net Operating Income |

$510.59 |

Similar to house #2, with this purchase I’ll be paying for 40% of the property and using a loan for the other 60%. The loan terms are identical to the loan I took for house #2: 10 year mortgage with a 7.25% interest rate. The monthly mortgage payment comes out to $385, bringing the monthly cash flow to $125.59.

| Item |

Amount |

|---|

| Rent |

$675.00 |

| Insurance |

$26.50 |

| Taxes |

$70.41 |

| Management |

-$67.50 |

| Net Operating Income |

$510.59 |

| Debt Services |

-$385.00 |

| Monthly cash flow |

$125.59 |

With these numbers, my cash on cash return will be around 6% depending on closing costs, and around 4% if we factor in vacancy and maintenance. For those of you who are looking at that number and not understanding how this could be a good investment, take a look at the last paragraph in my post about house #2.

by David | Mar 1, 2015 | Income Report

February was a month of getting back into the hunt for me. In January, things went quiet in the REI world for me since there was a lot to do at work and at home during the first few weeks of the year. But now I’m back to REI work. I spent a lot of time this month networking with fellow real estate investors and talking to turnkey real estate companies to learn what else is out there.

This past month, I also started researching multi-unit properties such as apartment buildings. Going from investing in single family homes to multi-units is a big leap, but I think it could be an important one since I understand that I need to scale in order for passive real estate investing to really impact my life.

All went well with my properties in February. Cash flow is identical to last month, and you can see the breakdown here:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

Total cash flow generated from passive real estate investing is $2,049.

Plans for March: continue to network with other real estate investors and turnkey companies to find my next purchase. Even though I’m researching multi-family units, I believe my next purchase will be a single family property. But I will be spending a good amount of time on researching multi-family options… I’ll keep you updated on how that goes.

by David | Feb 23, 2015 | My REI History

After owning real estate for about 6 months now, I’ve come to learn a few things and I wanted to share some thoughts with you:

Turtle speed.

With two rental properties, my monthly cash flow has been around $365 each month. That’s a 9% return on my investment which is a pretty good return. While a good return, this low amount of cash flow is teaching me that I need to continue spending time researching markets/properties and continue purchasing and investing in real estate. It also teaches me that staying in the single-family market is probably not a good idea. I need to grow and get into small multi-family units and also into larger apartment buildings. That’s probably the best way to “speed” things up and get larger amounts of monthly cash flow.

More isn’t better, it’s a must.

Owning two properties is great, but it’s not enough. There are a few reasons for that:

- The returns from two properties don’t meet my goals. My goal is to be able to retire early thanks to passive income from real estate. The cash flow from two properties (even after the mortgages are paid) is not enough to achieve that goal.

- While my properties are doing well so far (I haven’t had any problems with tenants or maintenance), in the future I will have expenses (maintenance, vacancy, etc.). If one of my two houses is vacant I’ll be at 50% vacancy which is very high and it will take a big bite out of my earnings. On the other hand, if I have ten units and two of them are vacant, my vacancy drops to 20% and the income from the other eight units will cover for the low performing units.

Staying focused.

I learned that staying focused on real estate investing isn’t easy! With a full-time job it’s not easy getting home after a long day and researching markets, networking, dealing with banks, title companies, etc. Furthermore, this isn’t something that can be done quickly. I don’t have the capital to buy 20 properties at this time; that will take several years, if not a decade. Because of this, I need to make sure I’m in the real estate game every day for the years to come. So, how can I stay focused? Well, there are a few things that help:

- Love it. I like real estate, which helps. More than that, I love the idea of early retirement. I love talking about it. I love sharing with others that there are possibilities beyond the 9-5 if they start thinking out-0f-the-box.

- Thinking about my “why.” I have a goal which is why I got into real estate. Whenever I feel like I don’t have energy, I just think about my “why,” or open this post (definitely helps to write it down!).

Looking at the future.

Last year I had a return of over 14% on my investment. Looking to the future, I can see that if both of my tenants leave at the end of their lease (August and December 2015), my returns are going to take a big hit since I’ll need to pay for getting the house ready for a new tenant and also for finding a new tenant. On the other hand, if I have 50 units and a handful of them leave each year, the hit on my total return will not hurt as much. This is, of course, the recurring theme: growth is the only way to achieve my goals!

by David | Feb 13, 2015 | Thoughts about REI

Since I can’t shut up about real estate investing, my friends often ask me why I don’t own my personal residence…

My wife and I currently rent. We live in a small, two-bedroom house which rents for under $1,000/month! We live in a great area so that price seems like a steal for us.Also, the cost of houses in our area is really high, so renting seemed like the better option for now. There are several other reasons why we decided to rent at this time:

Lower cost of living

If we were to purchase a house, our mortgage would be much higher than the cost of our rent. Beyond mortgage payments, there are additional expenses when owning a house (insurance, taxes, maintenance, etc.). So, our current situation allows us to save more money for real estate investing.

Best use of a down payment

Next, we all know (or should know) that purchasing a house to live in is not an investment. Owning a house does not provide cash flow as my investment properties do; in fact, owning a house would lead to negative cash flow. So if I have to choose between investing $100,000 – $200,000 in a few rental properties or investing in a house for my wife and I to live in, the first option sounds better.

Thinking about future needs

I would probably want to purchase something that would work for my family for the next decade or two at least. At this time, a two-bedroom house is enough for my wife and I, but that probably won’t be enough after we have a few kids. With renting, we always have the option of easily moving into a bigger place. If we were to purchase a house today, we would need to purchase a house that is much bigger than our current needs, which would mean even higher down payments and monthly payments.

Those are the main reasons we’ve opted to rent for ourselves and continue growing our investment properties. What are your reasons for making the same choice, or buying instead?

by David | Feb 1, 2015 | Income Report

During the month of January, I received two rent payments for the first time! I updated you about the purchase of my second property at the end of November and this month I received the December rent. So total rent collected this month was $1,520. Here’s a breakdown of each property:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

No problems with either of my rentals. Smooth sailing for the first month of the year.

In my previous post, I discussed how additional payments can be made toward the principal of the mortgage, and in that way you can pay back the loan quicker. I have decided to round up the payment for house B, making my total payment is $600/month, which includes the mortgage payment, insurance, taxes, and an additional $83.25 for the principal. If I continue with these payments, I’ll have payed off the loan by October 2022 instead of January 2025 and save $3,490.

At this point, my REI bank account has a total of $1,579, which is the amount of cash flow I received over the past 6 months (including the additional principal expenses).

That’s about all there is to this month’s income report. Stay tuned for a look into my considerations for house C, next month’s income report, and more.

by David | Jan 17, 2015 | Thoughts about REI

As I shared in previous posts, I currently own two properties in Memphis, TN. For both purchases I borrowed money in the form of a mortgage so that I only paid for part of the costs with my own money. These loans, the monthly mortgage payments, create the largest monthly expense with both properties.

Quick reminder in regard to the numbers behind my investments:

|

House A |

House B |

|---|

| Value |

$72,700 |

$58,700 |

| Down payment |

$14,540 |

$23,480 |

| Loan term |

30 years |

10 years |

| Loan interest rate |

5.125% |

7.25% |

| Monthly mortgage cost |

$316.67 |

$413 |

| Monthly cash flow |

$265 |

$128.5 |

The total sum of the mortgage payment has two parts to it: principal and interest. Principal refers to the actual amount of money I borrowed. So for house A, I took a loan of 80% of the house cost ($72,700), which comes out to a $58,160 loan that I will need to repay over the course of 30 years. Interest refers to the fee the bank charges, or the cost of this loan. With house A, I will pay a total of $55,842.50 in interest over the course of the 30-year loan. This brings us to a total (principal + interest) of $114,002.50 after 30 years. In other words, I’ll pay back $114,002.50 in return for a loan of $58,160.

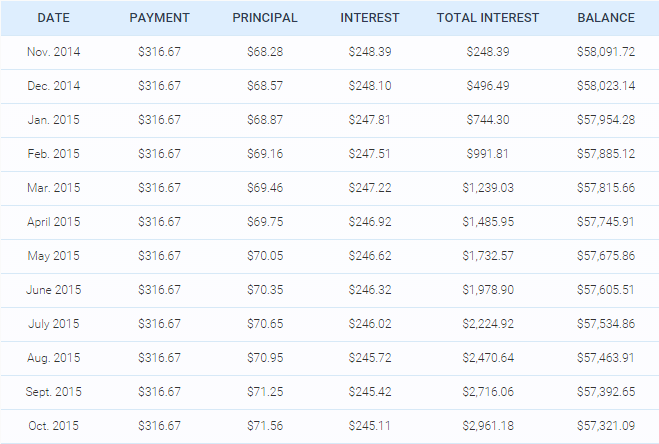

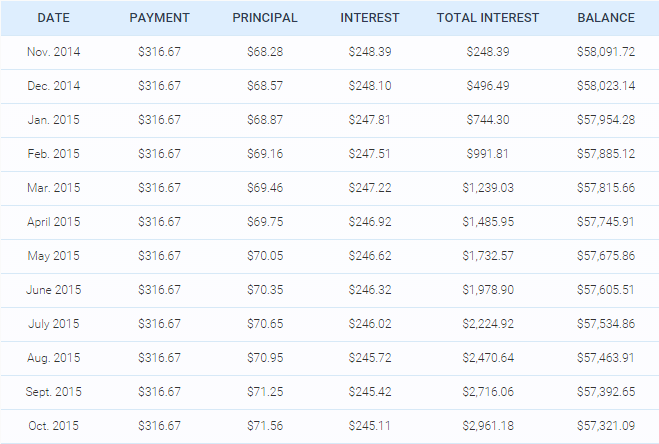

The monthly mortgage payment is always the same amount, for house A the total monthly mortgage payment is $316.67. That amount includes both the principal and interest. What’s interesting is that the amounts change each month. The amount paid towards the principal gets larger each month and the amount paid towards interest gets smaller each month. You can see an example Amortization Schedule sheet below (for the first year of my mortgage on house A). You’ll see the payment made each month, which stays the same at $316.67. Then you’ll see in the next two columns how the $316.67 is broken up into principal and interest. The next column shows the total interest paid thus far and the last column shows the balance or the amount I still owe (principal) on the loan:

If I pay more than the minimum amount, any additional payment goes towards decreasing my principal. Doing this will mean that I will repay the loan back more quickly, and since the loan is being payed off quicker, I’ll be paying less interest.

Let’s look at an example. Let’s look at what happens if I have an extra $50 a month, and I put that $50 toward paying back my mortgage every month (we’ll look at this scenario for each of my properties):

House A

|

Original |

With extra $50 |

Notes |

|---|

| Mortgage end data |

September 1, 2044 |

November 1, 2036 |

Pay off the mortgage 7.5 years sooner |

| Total interest paid |

$55,842.50 |

$39,184.23 |

Saved $16,658.27 |

House B

|

Original |

With extra $50 |

Notes |

|---|

| Mortgage end data |

December 1, 2024 |

November 1, 2036 |

Pay off the mortgage almost 1.5 years sooner |

| Total interest paid |

$14,398.38 |

$12,065.53 |

Saved $2,332.85 |

As you can see, with house A, I’d be able to repay the mortgage within 22.5 years instead of 30 years and save $16,658.27 on interest. With house B, I’d be able to repay the mortgage within 8.5 years and save $2,332.85 on interest.

What about cash flow?

Another inportant piece to look at is how much additional cash flow I’d earn by paying off the mortgage earlier. Looking at house B as an example, without paying any additional money each month toward the principal, the mortgage should be payed off within 10 years. But if I do pay an additional $50 each month, the mortgage will be paid off within 8.5 years. This means that I get 1.5 years without mortgage payments and my cash flow will be equal to the net operating income. So let’s see how much additional income I’d receive in those years between when I can pay down the mortgage and when I was originally supposed to pay it off.

|

Additional cash flow |

|---|

| House A |

$54,712.04 |

| House B |

$9,171.37 |

What you can see is that for house A, I’d receive an additional cash flow of $54,712.04 over the course of the last 7.5 years. In other words, instead of paying the mortgage over the course of 30 years and receiving around $265 in cash flow every month, I’d pay off the mortgage over the course of 22.5 years, receive $265 per month and over the course of the following 7.5 years I’d receive a cash flow of around $581.

To pay additional principal, or not to pay additional principal?

To see the full picture, we need to summarize the three main items that will impact the decision on whether or not to pay additional principal:

- Interest saved

- Additional cash flow

- Cost of paying the additional principal

Let’s take a look at these totals for both properties:

|

House A |

House B |

|---|

| Interest saved |

$16,658.27 |

$2,332.85 |

| Additional cash flow |

$54,712.04 |

$9,171.37 |

| Amount of additional principal payments |

-$13,310.14 |

-$5,151.78 |

| Total |

$58,060.17 |

$6,352.44 |

From this last table you can see that by making an additional monthly payment of $50 on each of my mortgages, over the course of 30 years I will make an additional $58,060 on house A, and over the course of 10 years I’ll make an additional $6,352 on house B.

Let’s do the same thing with amounts higher than $50. We’ll add $100, $150, $200, $250, for each of the houses.

House A

| Extra principal |

Mortgage end date |

Years saved |

Interest expenses saved |

Additional cash flow |

Extra amount spent |

Total savings |

|---|

| $100.00 |

June 1, 2032 |

12.26 |

$25,357.23 |

$85,577.20 |

$21,313.97 |

$89,620.46 |

| $150.00 |

August 1, 2029 |

15.10 |

$30,797.19 |

$105,369.92 |

$26,866.85 |

$109,300.26 |

| $200.00 |

July 1, 2027 |

17.18 |

$34,547.92 |

$119,941.95 |

$30,812.05 |

$123,677.81 |

| $250.00 |

January 1, 2026 |

18.68 |

$37,300.36 |

$130,383.32 |

$34,027.40 |

$133,656.29 |

| $300.00 |

October 1, 2024 |

19.93 |

$39,410.89 |

$139,122.72 |

$36,325.48 |

$142,208.13 |

| $350.00 |

November 1, 2023 |

20.85 |

$41,082.06 |

$145,529.05 |

$38,524.93 |

$148,086.18 |

House B

| Extra principal |

Mortgage end date |

Years saved |

Interest expenses saved |

Additional cash flow |

Extra amount spent |

Total savings |

|---|

| $100.00 |

May 1, 2022 |

2.59 |

$4,001.12 |

$16,699.32 |

$8,903.01 |

$11,797.42 |

| $150.00 |

July 1, 2021 |

3.42 |

$5,256.08 |

$22,071.37 |

$11,855.34 |

$15,472.11 |

| $200.00 |

November 1, 2020 |

4.08 |

$6,235.64 |

$26,347.81 |

$14,215.89 |

$18,367.56 |

| $250.00 |

May 1, 2020 |

4.59 |

$7,022.14 |

$29,599.32 |

$16,257.53 |

$20,363.92 |

| $300.00 |

November 1, 2019 |

5.09 |

$7,667.72 |

$32,815.48 |

$17,713.97 |

$22,769.23 |

| $350.00 |

July 1, 2019 |

5.42 |

$8,207.34 |

$34,989.04 |

$19,250.96 |

$23,945.42 |

What can we learn from all these numbers? Well, the main thing is that we can save money on interest and start earning higher cash flow when we pay additional principal payments. We also pay back the mortgage quicker which means we gain more equity sooner.

The bottom line is that we need to make sure our money is always working for us. As I collect rent and generate cash flow, I watch my bank account grow, but now the question is “what am I doing with the cash flow?” If it’s just sitting in the bank then I’m back at square one. I need to make sure the cash is working for me! To do this, I can use the cash flow in a few ways:

- Invest in new properties. This might take a while as I currently only generate a few hundred dollars each month and would need to wait many months until I had enough for a down payment on a house.

- Invest in the stock market, bonds, etc.

- Pay down the principal as discussed above.

Whatever you choose to do, the key is to make sure the money you’re generating is working for you.

by David | Jan 1, 2015 | Income Report

Happy New Year, everyone!

What an awesome year 2014 was! My wife and I completed a two-year cross country trip, settled down, and became real estate investors after purchasing two houses. Definitely an eventful year.

Let’s start out by looking at the past month and then we’ll summarize 2014.

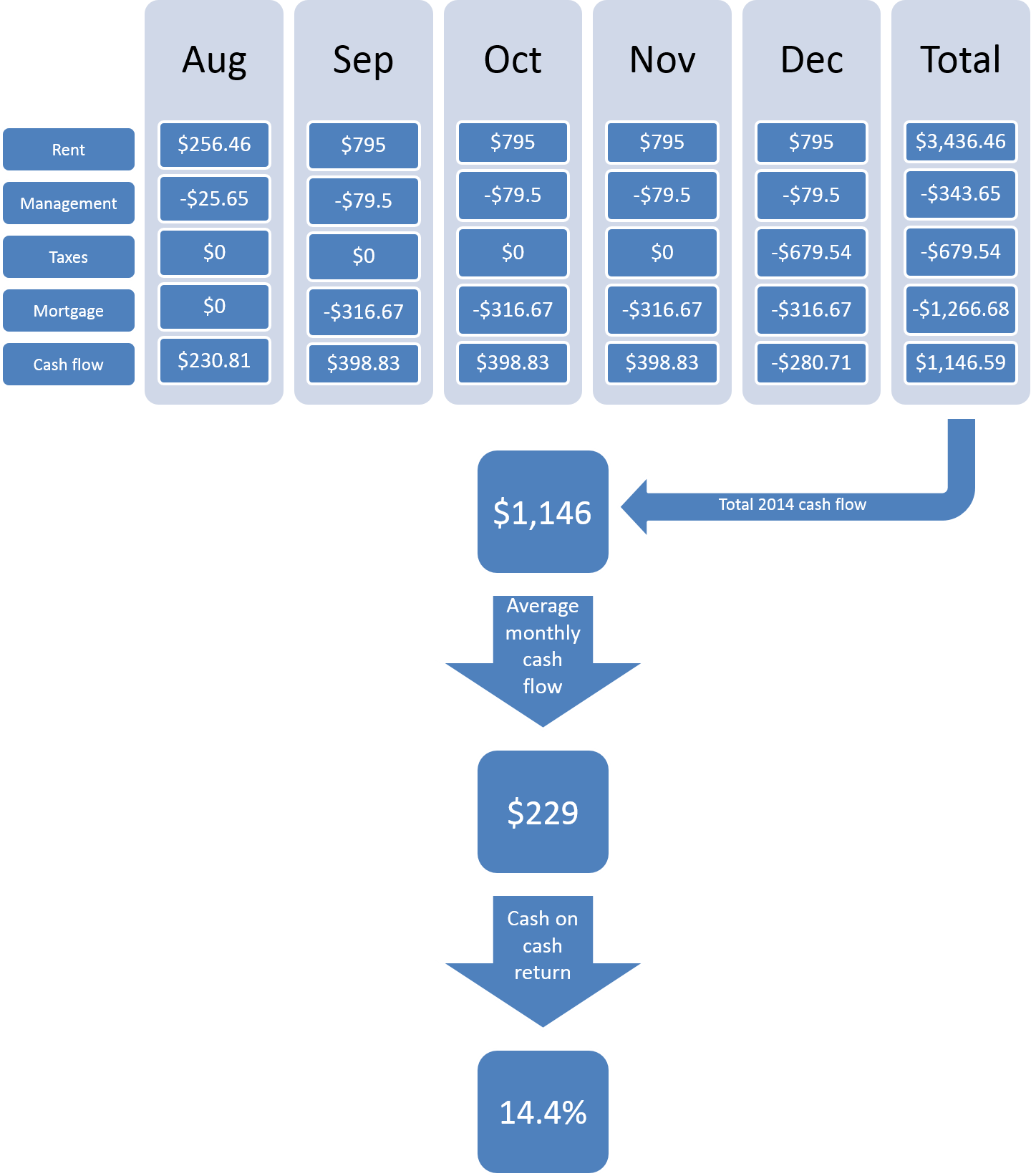

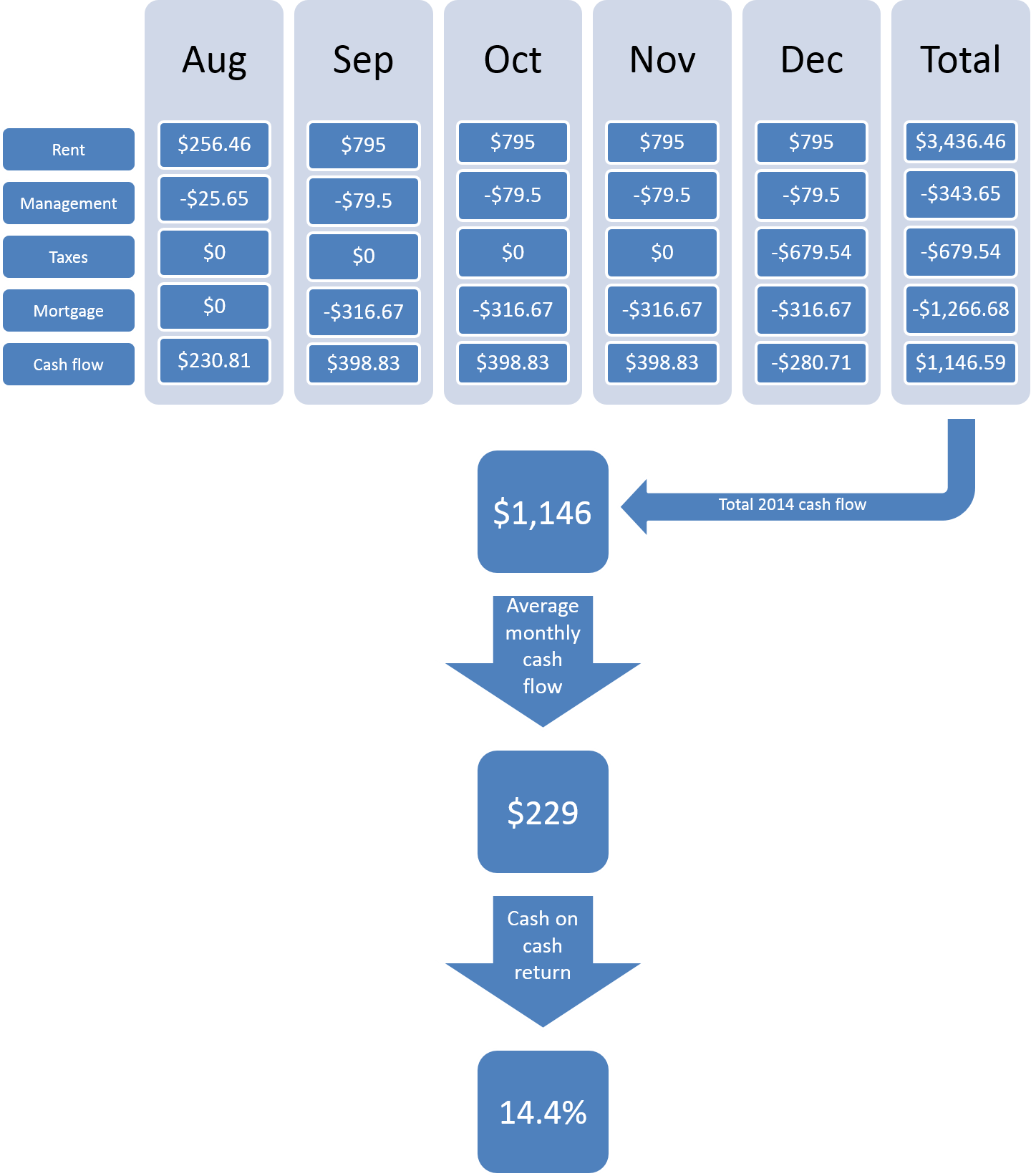

In regard to cash flow, we received payment for house A only, since house B was purchased at the end of November. We’ll see December’s rent payment for house B in next month’s income report. Income received from house A was $795 (as usual), but this month our cash flow took a hit since we paid our county property taxes, which came out to a total of $679.54 . Therefore the cash flow for this month was:

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

-$679.54 |

| Management |

-$79.50 |

| Total cash flow |

-$280.71 |

2014 Summary

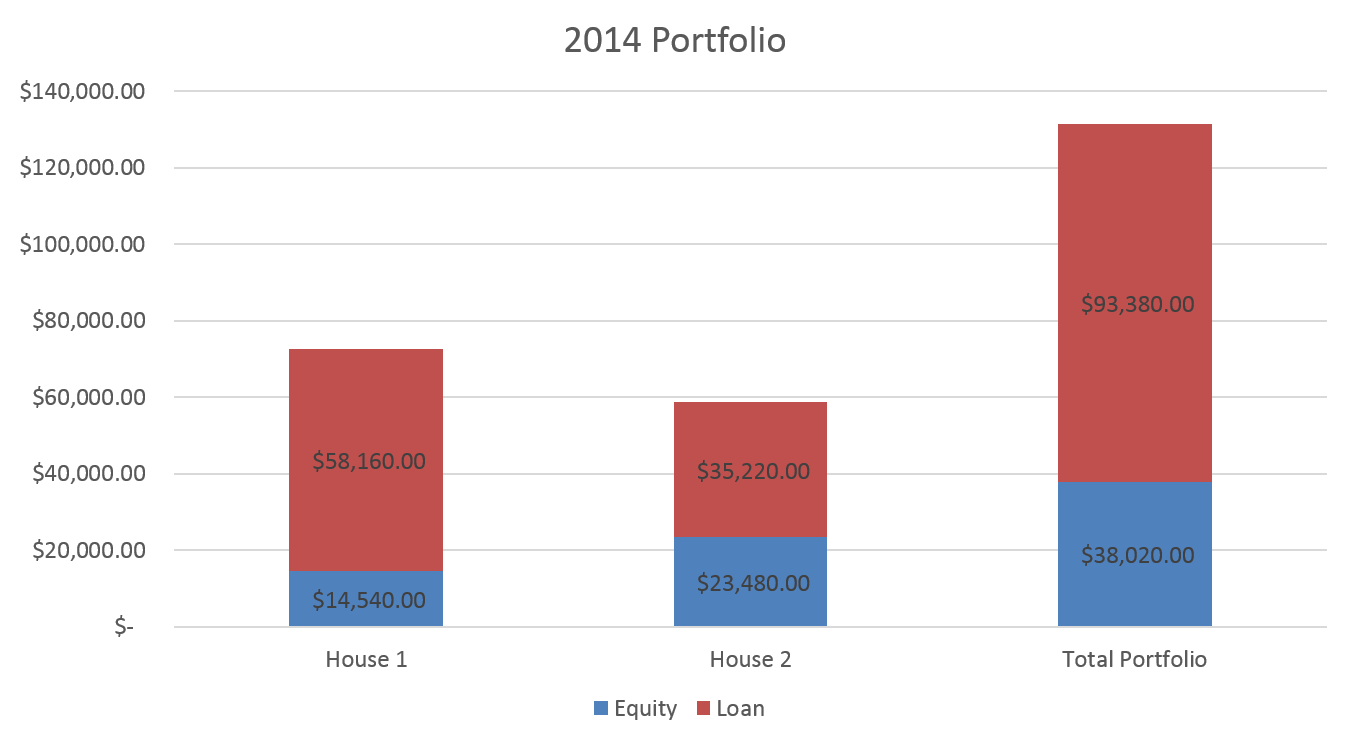

Finishing up my first year as a real estate investor, the numbers are looking pretty good. Let’s take a look at the portfolio and cash flow for 2014:

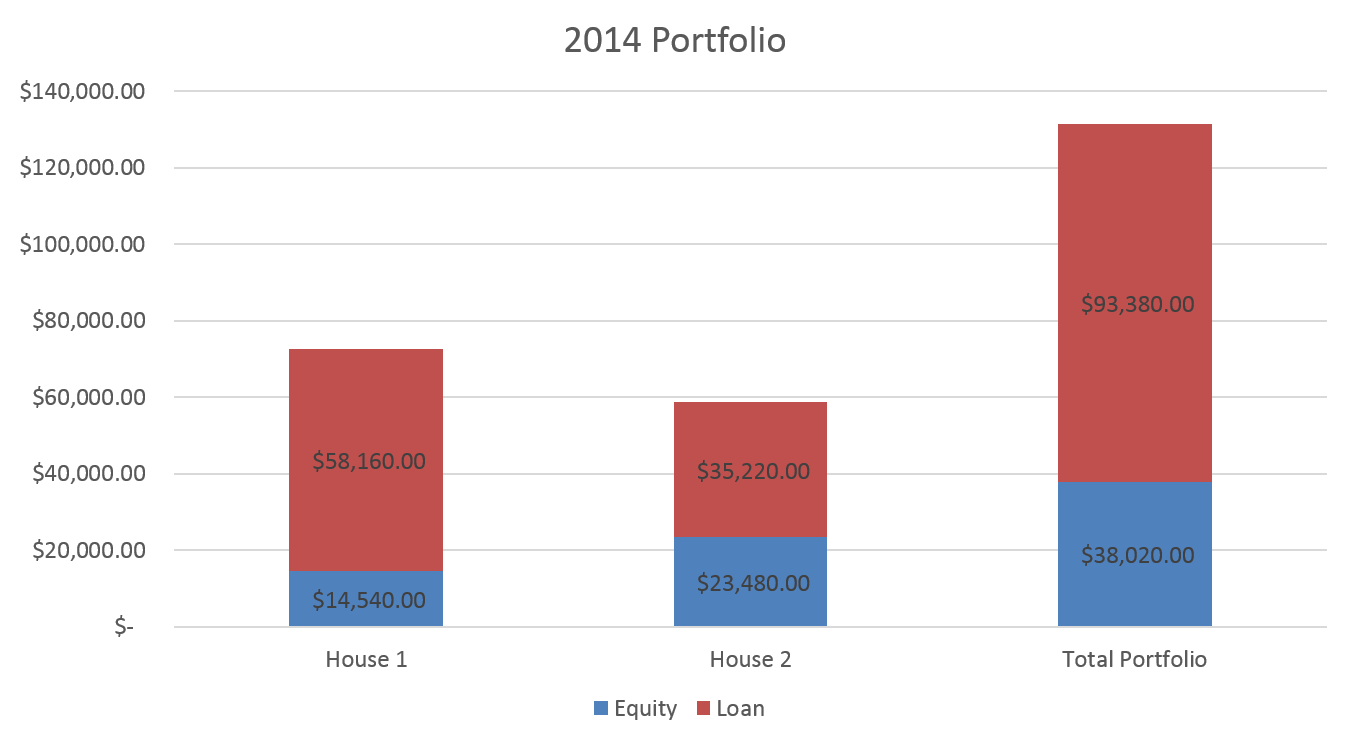

My portfolio details:

|

House 1 |

House 2 |

Total Portfolio |

|---|

| Equity |

$14,540 |

$23,480 |

$38,020 |

| Loan |

$58,160 |

$35,220 |

$93,380 |

| Total |

$72,700 |

$58,700 |

$131,400 |

Here’s a look at cash flow for 2014 and cash on cash return for the year:

As you can see, I received a total of $1,146 over the past 4.5 months after paying all expenses. This was for an investment of $19,000 ($14,000 down payment and $4,000 closing costs). That’s more than 14% return on my investment! Which is pretty good compared to 7-8%, the historic average return from the stock market.

Furthermore, this only includes the returns in cash flow. We haven’t taken into consideration additional benefits like appreciation, amortization, and tax benefits. I’ll get into more details on these benefits in upcoming posts.

Here’s to a successful and fruitful 2015!

by David | Dec 22, 2014 | Uncategorized

The only way to achieve anything is by setting goals. You can start with long-term goals like building a real estate portfolio worth $1,000,000, or creating $5,000 a month from passive real estate income. These long-term goals then need to be broken down by years, months, weeks, and days. There is no way we’ll reach our long-term goals if we don’t work towards them every day.

With that, the end of the year is a great time to look at existing long-term goals or make new ones. It’s also a great time to define the things you want to achieve in the upcoming year to help you reach those long-term goals. Here’s a look at my goals for 2015:

Finance goals:

- Save at least $45,000 – In order to accomplish this goal, I need to save $3,750 each month. Not a small amount, but in order to achieve financial freedom within the next decade, my wife and I are willing to live a frugal life (spend on things that are important to us and save everywhere else). The $3,750 each month will be divided into two: savings and investing. We’ll be saving for a few goals such as traveling and buying a house to live in. The money we save for investing will be divided into our IRA’s and to down payments on new real estate investments.

- Purchase 3 additional properties – Now that we have two properties, we’re hungry for more and want to build our passive income by purchasing additional properties. Our goal for 2015 is to buy three additional properties. At an average of $25,000 per down payment, we’re looking to invest around $75,000 (before closing costs).

- Grow my net worth to $150,000 (it’s currently at $100,000) – Assuming we can save $45,000 in 2015, that should help bring our net worth to around $150,000 (of course, if our IRAs and properties appreciate, that will help as well).

Personal goal:

- Start a family – This is a big one, and kind of scary. This is definitely the main goal for the year.

Passive REI blog goal:

- Write one post per week – I don’t have lots of plans for this blog… pretty much what I mentioned in the About page; keep myself accountable and share my journey with others. One post a week seems like a good amount and of course during interesting times like new projects or while closing I’ll blog more often. But for now once a week is my goal.

So these are my goals for 2015. In order to keep myself accountable, I’ll touch on these goals in my monthly income reports every quarter and at the end of the year.

Recent Comments