by David | Feb 13, 2015 | Thoughts about REI

Since I can’t shut up about real estate investing, my friends often ask me why I don’t own my personal residence…

My wife and I currently rent. We live in a small, two-bedroom house which rents for under $1,000/month! We live in a great area so that price seems like a steal for us.Also, the cost of houses in our area is really high, so renting seemed like the better option for now. There are several other reasons why we decided to rent at this time:

Lower cost of living

If we were to purchase a house, our mortgage would be much higher than the cost of our rent. Beyond mortgage payments, there are additional expenses when owning a house (insurance, taxes, maintenance, etc.). So, our current situation allows us to save more money for real estate investing.

Best use of a down payment

Next, we all know (or should know) that purchasing a house to live in is not an investment. Owning a house does not provide cash flow as my investment properties do; in fact, owning a house would lead to negative cash flow. So if I have to choose between investing $100,000 – $200,000 in a few rental properties or investing in a house for my wife and I to live in, the first option sounds better.

Thinking about future needs

I would probably want to purchase something that would work for my family for the next decade or two at least. At this time, a two-bedroom house is enough for my wife and I, but that probably won’t be enough after we have a few kids. With renting, we always have the option of easily moving into a bigger place. If we were to purchase a house today, we would need to purchase a house that is much bigger than our current needs, which would mean even higher down payments and monthly payments.

Those are the main reasons we’ve opted to rent for ourselves and continue growing our investment properties. What are your reasons for making the same choice, or buying instead?

by David | Jan 17, 2015 | Thoughts about REI

As I shared in previous posts, I currently own two properties in Memphis, TN. For both purchases I borrowed money in the form of a mortgage so that I only paid for part of the costs with my own money. These loans, the monthly mortgage payments, create the largest monthly expense with both properties.

Quick reminder in regard to the numbers behind my investments:

|

House A |

House B |

|---|

| Value |

$72,700 |

$58,700 |

| Down payment |

$14,540 |

$23,480 |

| Loan term |

30 years |

10 years |

| Loan interest rate |

5.125% |

7.25% |

| Monthly mortgage cost |

$316.67 |

$413 |

| Monthly cash flow |

$265 |

$128.5 |

The total sum of the mortgage payment has two parts to it: principal and interest. Principal refers to the actual amount of money I borrowed. So for house A, I took a loan of 80% of the house cost ($72,700), which comes out to a $58,160 loan that I will need to repay over the course of 30 years. Interest refers to the fee the bank charges, or the cost of this loan. With house A, I will pay a total of $55,842.50 in interest over the course of the 30-year loan. This brings us to a total (principal + interest) of $114,002.50 after 30 years. In other words, I’ll pay back $114,002.50 in return for a loan of $58,160.

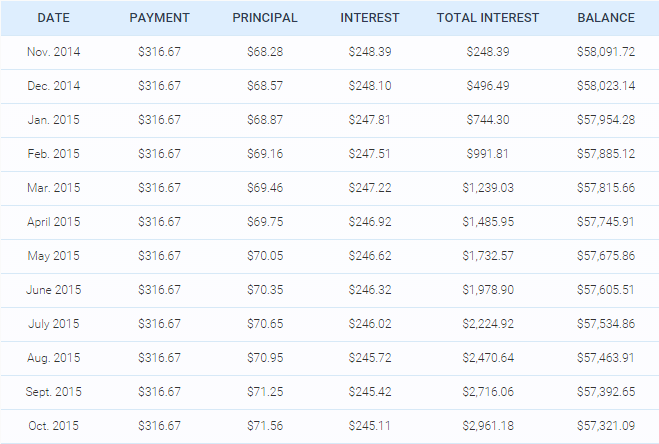

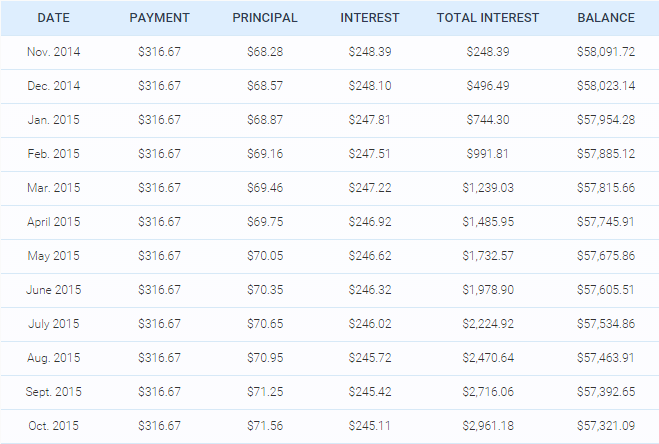

The monthly mortgage payment is always the same amount, for house A the total monthly mortgage payment is $316.67. That amount includes both the principal and interest. What’s interesting is that the amounts change each month. The amount paid towards the principal gets larger each month and the amount paid towards interest gets smaller each month. You can see an example Amortization Schedule sheet below (for the first year of my mortgage on house A). You’ll see the payment made each month, which stays the same at $316.67. Then you’ll see in the next two columns how the $316.67 is broken up into principal and interest. The next column shows the total interest paid thus far and the last column shows the balance or the amount I still owe (principal) on the loan:

If I pay more than the minimum amount, any additional payment goes towards decreasing my principal. Doing this will mean that I will repay the loan back more quickly, and since the loan is being payed off quicker, I’ll be paying less interest.

Let’s look at an example. Let’s look at what happens if I have an extra $50 a month, and I put that $50 toward paying back my mortgage every month (we’ll look at this scenario for each of my properties):

House A

|

Original |

With extra $50 |

Notes |

|---|

| Mortgage end data |

September 1, 2044 |

November 1, 2036 |

Pay off the mortgage 7.5 years sooner |

| Total interest paid |

$55,842.50 |

$39,184.23 |

Saved $16,658.27 |

House B

|

Original |

With extra $50 |

Notes |

|---|

| Mortgage end data |

December 1, 2024 |

November 1, 2036 |

Pay off the mortgage almost 1.5 years sooner |

| Total interest paid |

$14,398.38 |

$12,065.53 |

Saved $2,332.85 |

As you can see, with house A, I’d be able to repay the mortgage within 22.5 years instead of 30 years and save $16,658.27 on interest. With house B, I’d be able to repay the mortgage within 8.5 years and save $2,332.85 on interest.

What about cash flow?

Another inportant piece to look at is how much additional cash flow I’d earn by paying off the mortgage earlier. Looking at house B as an example, without paying any additional money each month toward the principal, the mortgage should be payed off within 10 years. But if I do pay an additional $50 each month, the mortgage will be paid off within 8.5 years. This means that I get 1.5 years without mortgage payments and my cash flow will be equal to the net operating income. So let’s see how much additional income I’d receive in those years between when I can pay down the mortgage and when I was originally supposed to pay it off.

|

Additional cash flow |

|---|

| House A |

$54,712.04 |

| House B |

$9,171.37 |

What you can see is that for house A, I’d receive an additional cash flow of $54,712.04 over the course of the last 7.5 years. In other words, instead of paying the mortgage over the course of 30 years and receiving around $265 in cash flow every month, I’d pay off the mortgage over the course of 22.5 years, receive $265 per month and over the course of the following 7.5 years I’d receive a cash flow of around $581.

To pay additional principal, or not to pay additional principal?

To see the full picture, we need to summarize the three main items that will impact the decision on whether or not to pay additional principal:

- Interest saved

- Additional cash flow

- Cost of paying the additional principal

Let’s take a look at these totals for both properties:

|

House A |

House B |

|---|

| Interest saved |

$16,658.27 |

$2,332.85 |

| Additional cash flow |

$54,712.04 |

$9,171.37 |

| Amount of additional principal payments |

-$13,310.14 |

-$5,151.78 |

| Total |

$58,060.17 |

$6,352.44 |

From this last table you can see that by making an additional monthly payment of $50 on each of my mortgages, over the course of 30 years I will make an additional $58,060 on house A, and over the course of 10 years I’ll make an additional $6,352 on house B.

Let’s do the same thing with amounts higher than $50. We’ll add $100, $150, $200, $250, for each of the houses.

House A

| Extra principal |

Mortgage end date |

Years saved |

Interest expenses saved |

Additional cash flow |

Extra amount spent |

Total savings |

|---|

| $100.00 |

June 1, 2032 |

12.26 |

$25,357.23 |

$85,577.20 |

$21,313.97 |

$89,620.46 |

| $150.00 |

August 1, 2029 |

15.10 |

$30,797.19 |

$105,369.92 |

$26,866.85 |

$109,300.26 |

| $200.00 |

July 1, 2027 |

17.18 |

$34,547.92 |

$119,941.95 |

$30,812.05 |

$123,677.81 |

| $250.00 |

January 1, 2026 |

18.68 |

$37,300.36 |

$130,383.32 |

$34,027.40 |

$133,656.29 |

| $300.00 |

October 1, 2024 |

19.93 |

$39,410.89 |

$139,122.72 |

$36,325.48 |

$142,208.13 |

| $350.00 |

November 1, 2023 |

20.85 |

$41,082.06 |

$145,529.05 |

$38,524.93 |

$148,086.18 |

House B

| Extra principal |

Mortgage end date |

Years saved |

Interest expenses saved |

Additional cash flow |

Extra amount spent |

Total savings |

|---|

| $100.00 |

May 1, 2022 |

2.59 |

$4,001.12 |

$16,699.32 |

$8,903.01 |

$11,797.42 |

| $150.00 |

July 1, 2021 |

3.42 |

$5,256.08 |

$22,071.37 |

$11,855.34 |

$15,472.11 |

| $200.00 |

November 1, 2020 |

4.08 |

$6,235.64 |

$26,347.81 |

$14,215.89 |

$18,367.56 |

| $250.00 |

May 1, 2020 |

4.59 |

$7,022.14 |

$29,599.32 |

$16,257.53 |

$20,363.92 |

| $300.00 |

November 1, 2019 |

5.09 |

$7,667.72 |

$32,815.48 |

$17,713.97 |

$22,769.23 |

| $350.00 |

July 1, 2019 |

5.42 |

$8,207.34 |

$34,989.04 |

$19,250.96 |

$23,945.42 |

What can we learn from all these numbers? Well, the main thing is that we can save money on interest and start earning higher cash flow when we pay additional principal payments. We also pay back the mortgage quicker which means we gain more equity sooner.

The bottom line is that we need to make sure our money is always working for us. As I collect rent and generate cash flow, I watch my bank account grow, but now the question is “what am I doing with the cash flow?” If it’s just sitting in the bank then I’m back at square one. I need to make sure the cash is working for me! To do this, I can use the cash flow in a few ways:

- Invest in new properties. This might take a while as I currently only generate a few hundred dollars each month and would need to wait many months until I had enough for a down payment on a house.

- Invest in the stock market, bonds, etc.

- Pay down the principal as discussed above.

Whatever you choose to do, the key is to make sure the money you’re generating is working for you.

by David | Nov 12, 2014 | Thoughts about REI

One of the most common questions friends have been asking me is: how do you have money for down payments? They say things like “I don’t make enough money,” or “I’m still paying off my credit cards and student loans,” or “we barely break even between our paycheck and expenses.” And those are only some of the reasons (or excuses) people have for not investing.

The key to real estate investing is that anyone can do it–it’s just a matter of deciding that you want to and then making choices to help move you in the right direction. Some things help, like having savings. (Step 1: spend less than you earn.)

There are some great bloggers who write on the topic of saving money (they’re like “Jedi Masters,” whereas I’m just a “Jedi Padawan” in this area, so I’ll let them take it away). Here are a couple I follow:

- Afford Anything

- Budgets are Sexy

by David | Oct 12, 2014 | Thoughts about REI

For my first real estate purchase, I used a Fannie Mae/Freddie Mac loan which had pretty good conditions. It’s a 30-year loan with a 20% down payment at an interest rate of 5.125%. Since I don’t qualify for a loan with those conditions at this time, I spent this month searching for other loan options.

The best option I’ve found is provided by one of the turnkey companies I’ve been in touch with. It’s a 10-year loan, the down payment is 40% of the house value, and the interest rate is 7.5% (while higher than the interest rate I’m paying on my first property, other lenders I spoke with offer interest rates as high as 12-15%).

So, what would this loan look like vs. the loan I received for property #1? Let’s examine the costs of property #1 with the loan I took for it (lets call it the “original loan”), and with the loan I’ll be using on property #2 (we’ll call that the “new loan”):

Original Loan

Down payment (20%) – $14,540.00

Loan term – 30 years

Interest rate – 5.125%

Monthly loan payment – $316.67

Monthly cash flow – $265

Cash on cash return – 17%

New Loan

Down payment (40%) – $29,080.00

Loan term – 10 years

Interest rate – 7.5%

Monthly loan payment – $518

Monthly cash flow – $63.67

Cash on cash return – 2%

As you can see, when looking at the cash flow, the 30-year loan has an advantage since it provides over $3,000 of cash flow per year, while the 10-year loan provides under $750 per year. However, after 10 years, the new loan will be entirely paid off, bringing the monthly cash flow to $581.67 (or $6,980 per year). That’s a 21% return from the initial $29,080 down payment.

To conclude, if we’re not looking for immediate cash flow, or if our goal is to create passive income in 10 years from now, the new loan can be an attractive option. So when you’re checking out different loan options, keep in mind what your goals are and you may see that initially less-attractive loans may turn out to be worthwhile.

Recent Comments