by David | Jun 1, 2015 | Income Report

This month is my first income report which includes my three rental properties. The income for property #3 is only for the last few days of the month since I purchased the property on April 29th. Next month we’ll see the full income for all three.

This month, was all “passive”. I had no problems with my properties and everything has been smooth sailing. Here’s the breakdown for each property.

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

House C

| Item |

Amount |

|---|

| Rent |

$22.50 |

| Mortgage |

$0.00 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$2.25 |

| Cash flow |

$20.25 |

Total for May

| Item |

Amount |

|---|

| Rent |

$1,542.50 |

| Expenses |

-$987.76 |

| Cash flow |

$554.74 |

by David | May 1, 2015 | Income Report

I closed house #3 this month! I shared that I found house #3 in an earlier post and was able to close on the 29th of April! 9 months into the real estate investing game and I was able to purchase 3 cash flowing properties. More about house #3 in next month’s income report, for now here are the numbers from my previous investments:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

Total cash flow over the past 9 months has been $2,500. My bank account has been growing and I haven’t been doing anything. This is a crazy concept for me to grasp, since I’m so used to only receiving income as part of my salary, and that is in exchange for my time at work. Here it’s money that I make passively!

by David | Apr 1, 2015 | Income Report

March, like February, was pretty normal in regards to income from my two rental properties. I spent time this month checking out different properties and, as I wrote in a previous post, I found house #3 which is currently being renovated.

This month’s numbers are:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

Since it’s the end of the first quarter of 2015, I spent some time looking at the goals I defined for this year and checking where I’m at with each. Here’s a quick review:

- Finance goals:

- Save at least $45,000 – So far this year, we were able to save $12,000 which puts us slightly above our monthly goal of $3,750.

- Purchase 3 additional properties – I plan to purchase my third rental property next month so we’ll be at 1 out of 3 for the year.

- Grow my net worth to $150,000 (it’s currently at $100,000) – Since the savings are going well, we’re on course with this goal. Other pieces that are working to my advantage is:

- Amortization – the fact that rent paid by my tenants is paying off the mortgages and specifically the principle I owe means that I own more of each house (slowly but surely). I’ll calculate this and blog more about it towards the end of the year.

- House value increase – House prices going up will also contribute to the net worth goal.

- Real estate income – Besides saving from the income we receive from our day jobs, we also have a stream of income from our rentals which is helping our net worth grow. Some of the cash flow we use to make additional payments on the mortgage and reduce the principal, but the rest is accumulating and working toward building our net worth.

- Personal goal:

- Start a family – We’re pregnant! Super cool and super exciting! It’ll be interesting to see how having a baby will affec our ability to continue saving.

- Passive REI blog goal:

- Write one post per week – I haven’t been doing well in this area. I’m currently at about one post every two weeks, so I will need to spend more time on the blog since there is a lot I’d like to share!

So that’s how 2015 is starting out! What do you think?

by David | Mar 1, 2015 | Income Report

February was a month of getting back into the hunt for me. In January, things went quiet in the REI world for me since there was a lot to do at work and at home during the first few weeks of the year. But now I’m back to REI work. I spent a lot of time this month networking with fellow real estate investors and talking to turnkey real estate companies to learn what else is out there.

This past month, I also started researching multi-unit properties such as apartment buildings. Going from investing in single family homes to multi-units is a big leap, but I think it could be an important one since I understand that I need to scale in order for passive real estate investing to really impact my life.

All went well with my properties in February. Cash flow is identical to last month, and you can see the breakdown here:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

Total cash flow generated from passive real estate investing is $2,049.

Plans for March: continue to network with other real estate investors and turnkey companies to find my next purchase. Even though I’m researching multi-family units, I believe my next purchase will be a single family property. But I will be spending a good amount of time on researching multi-family options… I’ll keep you updated on how that goes.

by David | Feb 1, 2015 | Income Report

During the month of January, I received two rent payments for the first time! I updated you about the purchase of my second property at the end of November and this month I received the December rent. So total rent collected this month was $1,520. Here’s a breakdown of each property:

House A

| Item |

Amount |

|---|

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

$0.00 |

| Management |

-$79.50 |

| Cash flow |

$398.83 |

House B

| Item |

Amount |

|---|

| Rent |

$725.00 |

| Mortgage |

-$413.49 |

| Insurance |

-$30.58 |

| Taxes |

-$72.68 |

| Management |

-$72.50 |

| Cash flow |

$135.75 |

No problems with either of my rentals. Smooth sailing for the first month of the year.

In my previous post, I discussed how additional payments can be made toward the principal of the mortgage, and in that way you can pay back the loan quicker. I have decided to round up the payment for house B, making my total payment is $600/month, which includes the mortgage payment, insurance, taxes, and an additional $83.25 for the principal. If I continue with these payments, I’ll have payed off the loan by October 2022 instead of January 2025 and save $3,490.

At this point, my REI bank account has a total of $1,579, which is the amount of cash flow I received over the past 6 months (including the additional principal expenses).

That’s about all there is to this month’s income report. Stay tuned for a look into my considerations for house C, next month’s income report, and more.

by David | Jan 1, 2015 | Income Report

Happy New Year, everyone!

What an awesome year 2014 was! My wife and I completed a two-year cross country trip, settled down, and became real estate investors after purchasing two houses. Definitely an eventful year.

Let’s start out by looking at the past month and then we’ll summarize 2014.

In regard to cash flow, we received payment for house A only, since house B was purchased at the end of November. We’ll see December’s rent payment for house B in next month’s income report. Income received from house A was $795 (as usual), but this month our cash flow took a hit since we paid our county property taxes, which came out to a total of $679.54 . Therefore the cash flow for this month was:

| Rent |

$795.00 |

| Mortgage |

-$316.67 |

| Insurance |

$0.00 |

| Taxes |

-$679.54 |

| Management |

-$79.50 |

| Total cash flow |

-$280.71 |

2014 Summary

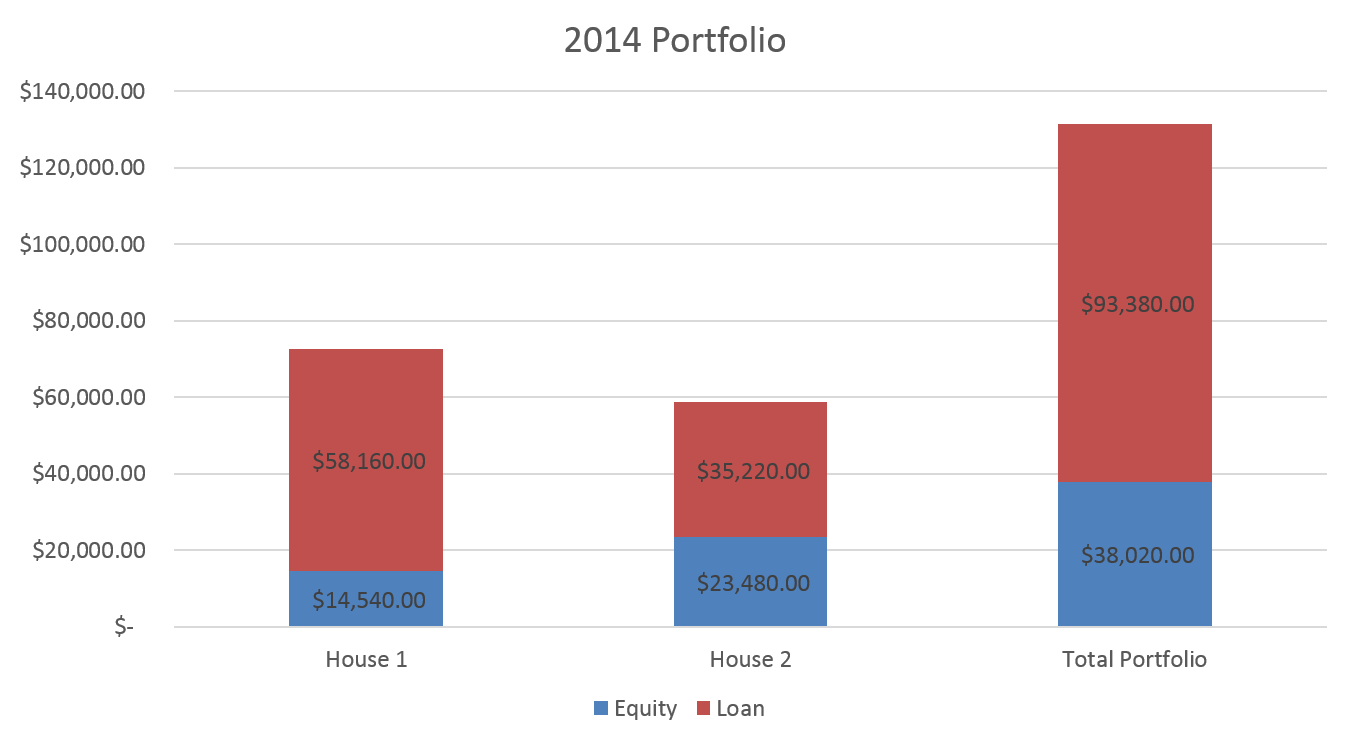

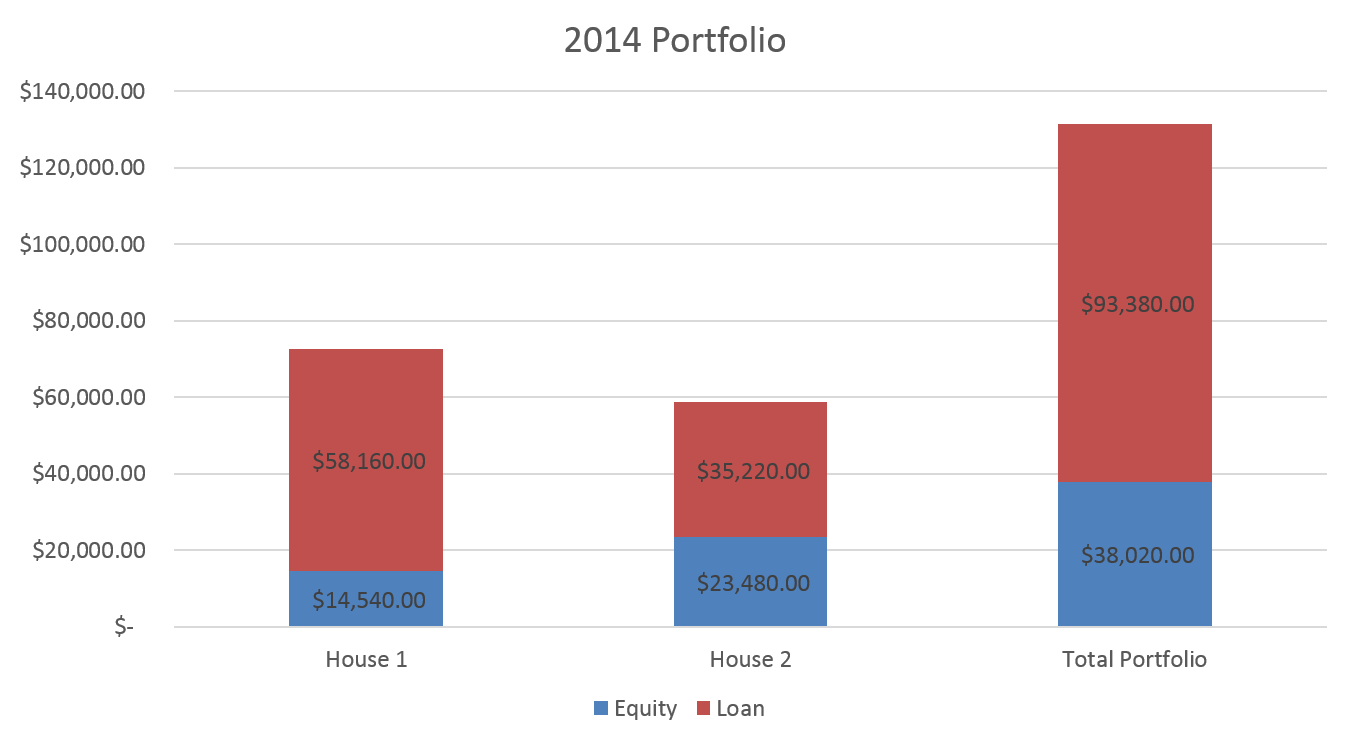

Finishing up my first year as a real estate investor, the numbers are looking pretty good. Let’s take a look at the portfolio and cash flow for 2014:

My portfolio details:

|

House 1 |

House 2 |

Total Portfolio |

|---|

| Equity |

$14,540 |

$23,480 |

$38,020 |

| Loan |

$58,160 |

$35,220 |

$93,380 |

| Total |

$72,700 |

$58,700 |

$131,400 |

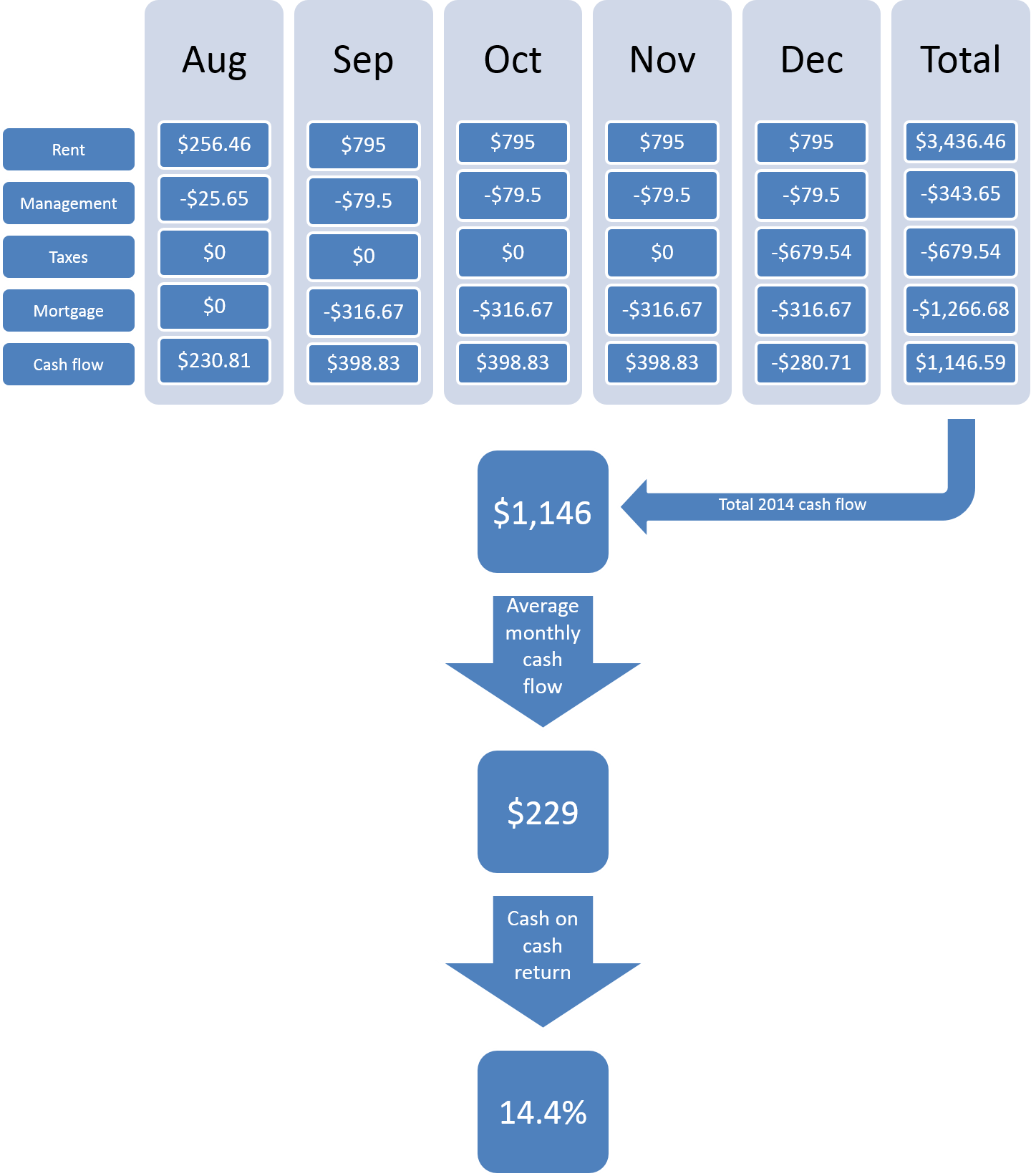

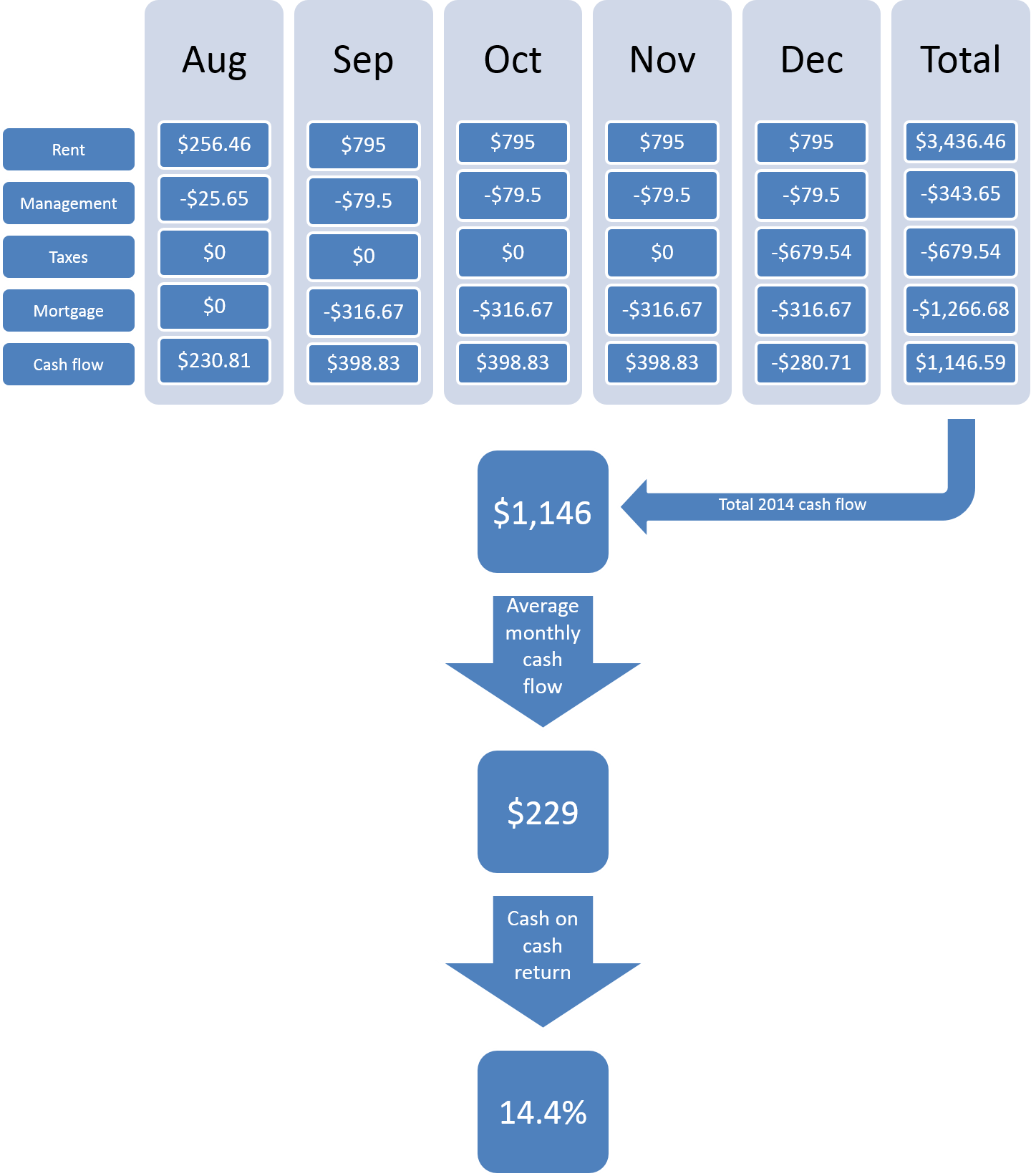

Here’s a look at cash flow for 2014 and cash on cash return for the year:

As you can see, I received a total of $1,146 over the past 4.5 months after paying all expenses. This was for an investment of $19,000 ($14,000 down payment and $4,000 closing costs). That’s more than 14% return on my investment! Which is pretty good compared to 7-8%, the historic average return from the stock market.

Furthermore, this only includes the returns in cash flow. We haven’t taken into consideration additional benefits like appreciation, amortization, and tax benefits. I’ll get into more details on these benefits in upcoming posts.

Here’s to a successful and fruitful 2015!

Recent Comments