Happy New Year, everyone!

What an awesome year 2014 was! My wife and I completed a two-year cross country trip, settled down, and became real estate investors after purchasing two houses. Definitely an eventful year.

Let’s start out by looking at the past month and then we’ll summarize 2014.

In regard to cash flow, we received payment for house A only, since house B was purchased at the end of November. We’ll see December’s rent payment for house B in next month’s income report. Income received from house A was $795 (as usual), but this month our cash flow took a hit since we paid our county property taxes, which came out to a total of $679.54 . Therefore the cash flow for this month was:

| Rent | $795.00 |

| Mortgage | -$316.67 |

| Insurance | $0.00 |

| Taxes | -$679.54 |

| Management | -$79.50 |

| Total cash flow | -$280.71 |

2014 Summary

Finishing up my first year as a real estate investor, the numbers are looking pretty good. Let’s take a look at the portfolio and cash flow for 2014:

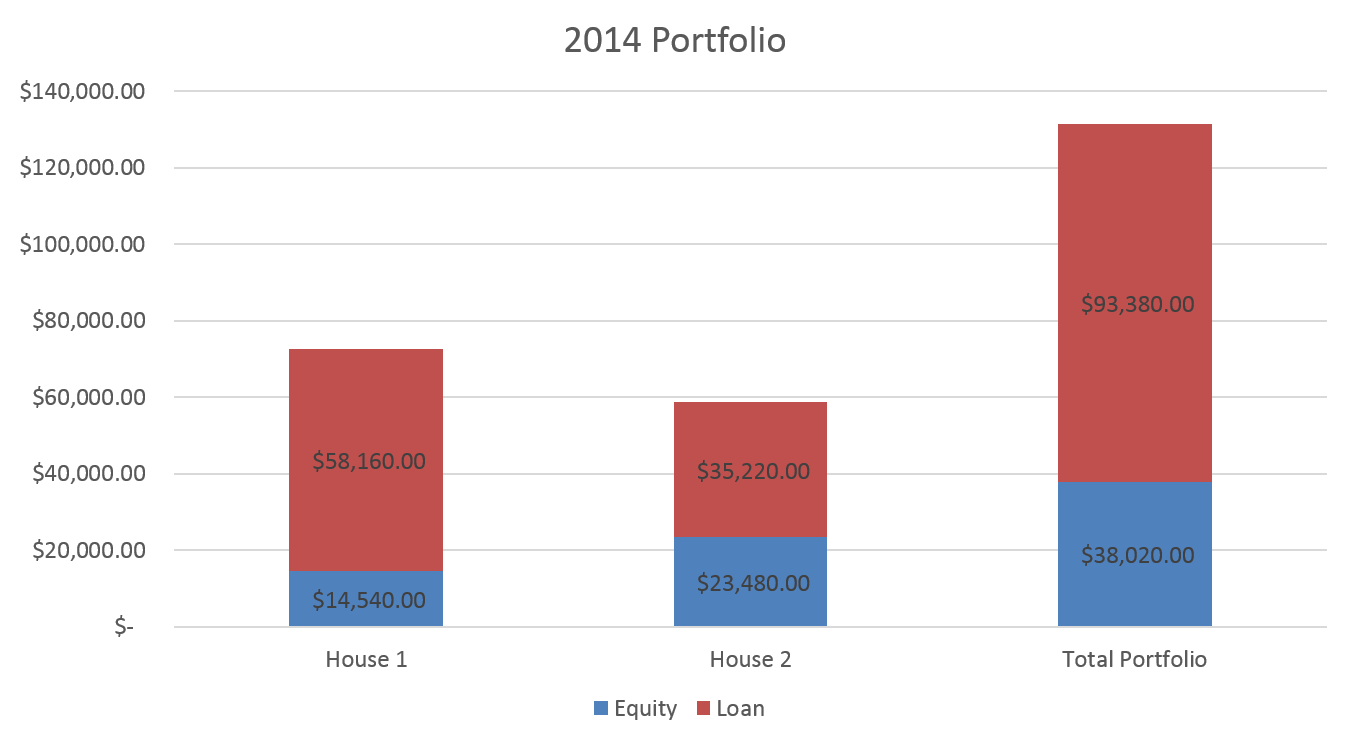

My portfolio details:

| House 1 | House 2 | Total Portfolio | |

|---|---|---|---|

| Equity | $14,540 | $23,480 | $38,020 |

| Loan | $58,160 | $35,220 | $93,380 |

| Total | $72,700 | $58,700 | $131,400 |

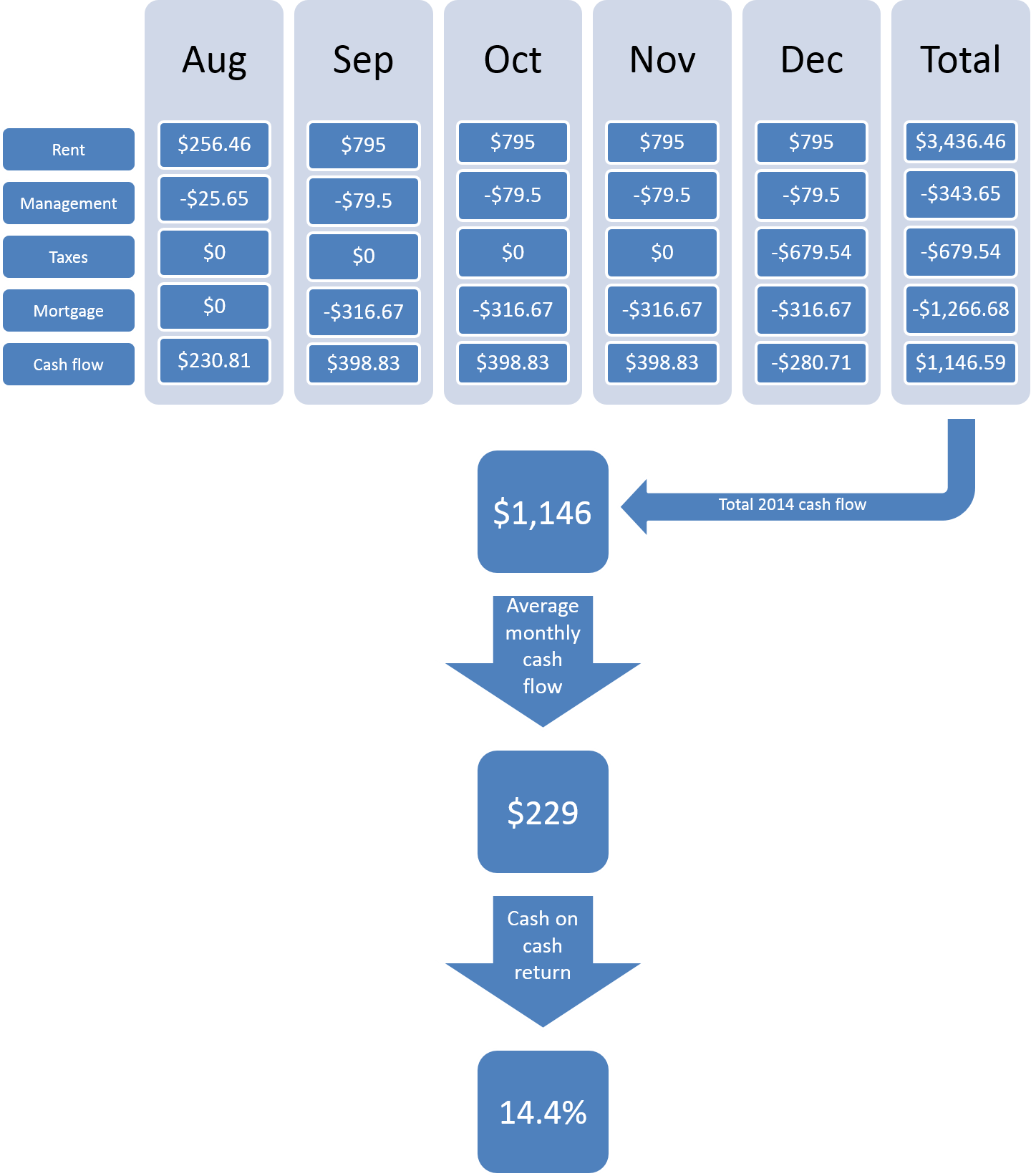

Here’s a look at cash flow for 2014 and cash on cash return for the year:

As you can see, I received a total of $1,146 over the past 4.5 months after paying all expenses. This was for an investment of $19,000 ($14,000 down payment and $4,000 closing costs). That’s more than 14% return on my investment! Which is pretty good compared to 7-8%, the historic average return from the stock market.

Furthermore, this only includes the returns in cash flow. We haven’t taken into consideration additional benefits like appreciation, amortization, and tax benefits. I’ll get into more details on these benefits in upcoming posts.

Here’s to a successful and fruitful 2015!

Recent Comments